The Dow Jones Industrial Average, commonly referred to as the Dow Jones, stands as one of the most watched stock indices in the world, representing the heartbeat of the U.S. economy and the broader stock market. This article provides a comprehensive look into the Dow Jones, from its historical significance to its current dynamics, offering insights into how it reflects economic trends and investor sentiment.

The Origins and Evolution of the Dow Jones

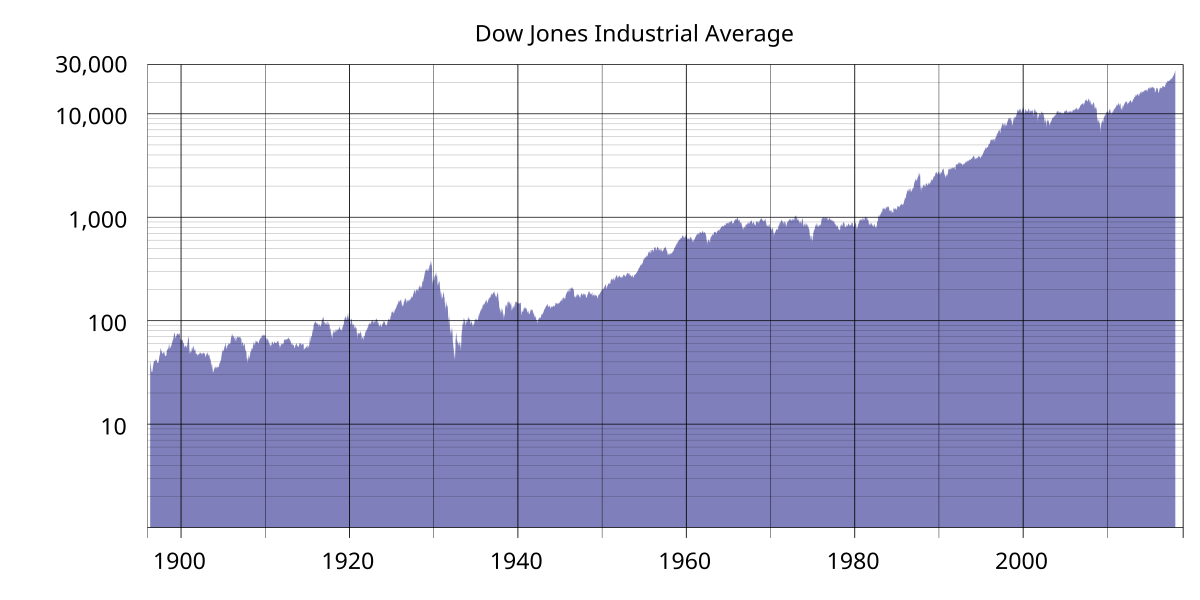

The Dow Jones Industrial Average was established on May 26, 1896, by Charles Dow, a journalist, and Edward Jones, a statistician. The index initially consisted of 12 companies predominantly within the industrial sector, reflecting the economic landscape of the United States at the time. Today, the Dow Jones has expanded to include 30 large publicly-owned companies, representing a wide spectrum of industries except for transportation and utilities, which are covered by other Dow Jones averages.

The evolution of the Dow Jones is a testament to the changing U.S. economy. From its early focus on industrial companies, the index now includes technology giants, healthcare leaders, and financial institutions, showcasing the diverse and dynamic nature of modern American business.

The Significance of the Dow Jones in Today’s Market

Benchmark for Economic Health

The Dow Jones serves as a critical benchmark for the overall health of the U.S. economy and the stock market. By tracking 30 significant corporations, the index provides a snapshot of the economic prowess and market sentiment, offering investors and analysts insights into potential economic trends and cycles.

Indicator of Investor Sentiment

The fluctuations in the Dow Jones are often seen as direct reflections of investor sentiment, influenced by domestic and international economic news, geopolitical events, and financial reports of its constituent companies. The index’s movements can signal investor confidence or concern, guiding financial strategies and decisions.

Analyzing the Performance of the Dow Jones

Key Drivers of Change

The performance of the Dow Jones is influenced by various factors including economic indicators like GDP growth rates, unemployment figures, and inflation rates, as well as corporate earnings reports and changes in U.S. monetary policy. Additionally, international events such as trade wars, global economic downturns, and political instability can also impact the index.

The Role of Technological Innovations

In recent years, technological advancements have had a profound impact on the Dow Jones. Companies that adapt and innovate continue to drive the index’s growth, reflecting the increasing importance of technology in the economy. This shift underscores the necessity for investors to consider technological capabilities and innovations as key components of investment decisions.

Challenges and Criticisms of the Dow Jones

Despite its prominence, the Dow Jones is not without its criticisms. One major critique is its price-weighted nature, where companies with higher stock prices have a more significant impact on the index’s performance, regardless of their economic size or market capitalization. This can skew perceptions of the market’s direction and health.

Moreover, with only 30 companies included, some analysts argue that the Dow Jones does not adequately represent the broader U.S. economy or the stock market, compared to other indices such as the S&P 500, which includes a larger and more diverse set of companies.

The Future of the Dow Jones

As the U.S. economy continues to evolve, so too will the Dow Jones. The inclusion or exclusion of companies from the index is a continuous process that reflects ongoing changes in the economic landscape. Looking ahead, the Dow Jones will likely continue to adapt, integrating more companies from burgeoning industries such as renewable energy and biotechnology, which could redefine the economic narrative of the next decade.

Conclusion: The Enduring Relevance of the Dow Jones

The Dow Jones Industrial Average remains a cornerstone of the financial world, providing key insights into the U.S. economy and investor behavior. Despite its limitations and criticisms, the Dow Jones continues to be revered as a barometer of market health and economic direction. Its ability to evolve with the economy ensures its place as an essential tool for investors and analysts alike, guiding financial strategies and offering a window into the complexities of the global market. As we look to the future, the Dow Jones will undoubtedly continue to play a critical role in the financial narrative, adapting to new economic realities and continuing to reflect the pulse of the economic landscape.